Gift Letter 2004-2026 free printable template

Show details

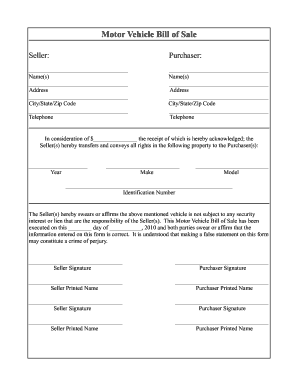

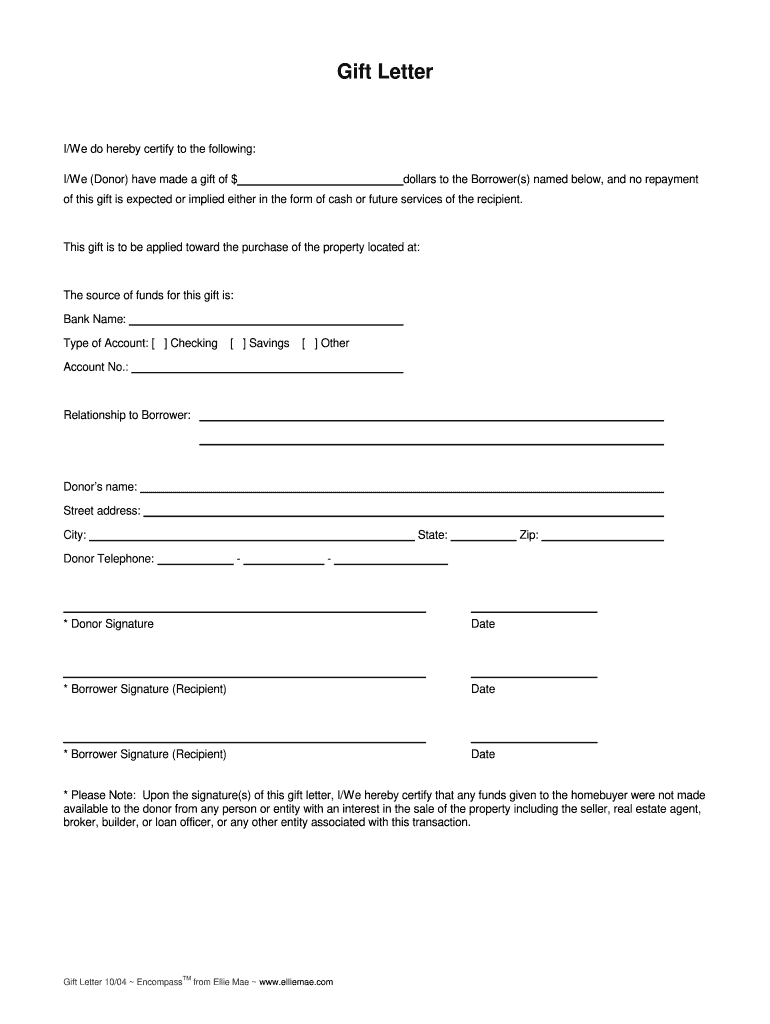

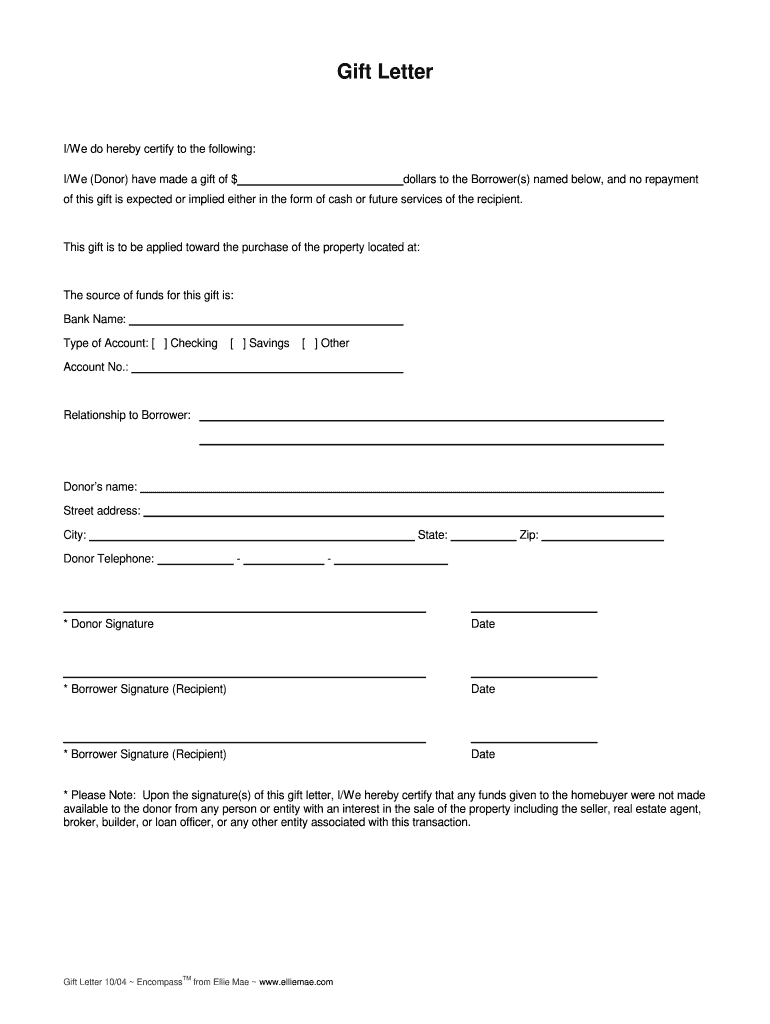

This gift is to be applied toward the purchase of the property located at The source of funds for this gift is Bank Name Type of Account Checking Savings Other Account No. Relationship to Borrower Donor s name Street address City State Donor Telephone - Zip - Donor Signature Date Borrower Signature Recipient Please Note Upon the signature s of this gift letter I/We hereby certify that any funds given to the homebuyer were not made available to the donor from any person or entity with an...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign printable gift letter for mortgage form

Edit your gift statement letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift funds letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing encompass gift pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gift letter for mortgage form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift letter for mortgage template form

How to fill out Gift Letter

01

Begin with the date at the top of the letter.

02

Include the names and addresses of both the giver and the recipient.

03

Clearly state the purpose of the letter, indicating that it is a gift.

04

Specify the amount of the gift being given.

05

Affirm that the funds are a gift and do not require repayment.

06

Sign and date the letter.

Who needs Gift Letter?

01

People receiving financial assistance for home purchases.

02

Individuals applying for a mortgage who are receiving monetary gifts.

03

Family members or friends providing financial support.

Fill

fannie mae gift letter

: Try Risk Free

People Also Ask about ellie mae gift letter

How do I write a letter to give a mortgage as a gift?

How Do You Write a Gift Letter for a Mortgage? Donor's name and contact information. Address of property being purchased. Donor and buyer's relationship. Gift amount. Date of gift transfer. A statement that repayment isn't expected by the donor. Donor's bank, account number, and type of account. Donor's signature.

What documentation is required when a gift is being used in a conventional loan?

Gifts must be evidenced by a letter signed by the donor, called a gift letter. The gift letter must: specify the actual or the maximum dollar amount of the gift; include the donor's statement that no repayment is expected; and.

How do you prove a gift for a mortgage?

Prove The Source Of Your Down Payment Your lender might deny you a mortgage. The solution is to ask for a gift letter to accompany any large financial gift you use for your down payment. A gift letter is a statement that ensures your lender the money that came into your account is a gift and not a loan.

Do lenders verify gift letters?

Be Ready For Lenders To Investigate A gift letter isn't always the only evidence needed to prove that the money in your account is legitimate. Your lender might contact your donor and ask them to provide withdrawal and deposit slips to verify the transaction.

How do you write a proof of gift letter?

It needs to include: Their name. Your name. The total amount given. A statement that it is a gift. A statement that the gift has no commercial interest. Confirmation that the gift giver has no stake in the property. Confirmation that the gift giver can afford to give you the money.

Can you use a gift on a conventional loan?

Using your gift money with a conventional loan Most conventional mortgage loans allow homebuyers to use gift money for their down payment and closing costs as long as it's a gift from an acceptable source, such as from family members.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gift letter template directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your gift letter borrower and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the gift letter person electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit mortgage gift letter template straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing fnma gift letter, you can start right away.

What is Gift Letter?

A Gift Letter is a document that outlines a financial gift given by one party to another, typically used in real estate transactions to show that the funds for a property purchase are a gift rather than a loan.

Who is required to file Gift Letter?

The person receiving the gift, typically the home buyer, is required to file a Gift Letter when applying for a mortgage to confirm that the funds are a gift and not a loan.

How to fill out Gift Letter?

To fill out a Gift Letter, both the donor and recipient must provide their names, addresses, the amount of the gift, the relationship between them, and a statement declaring that the funds are a gift with no expectation of repayment.

What is the purpose of Gift Letter?

The purpose of a Gift Letter is to verify the source of funds for a home purchase and to establish that the financial assistance is a gift rather than a loan, which can affect loan eligibility.

What information must be reported on Gift Letter?

Information that must be reported on a Gift Letter includes the donor's and recipient's names and addresses, the amount of the gift, the relationship between the parties, a statement of intent for the gift, and the donor's signature.

Fill out your Gift Letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae Gift Letter Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to donor gift letter

Related to gift letter for mortgage template pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.